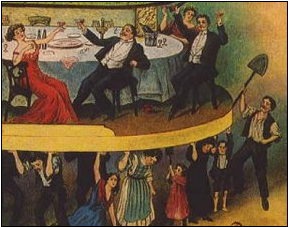

The news these days is filled with Republican candidates, current congressman and senators, the 99 percent, and, of course, President Obama stating their case(s) for or against taxing the rich or the 1 percent. When I listen to all of the rhetoric and political posturing I am reminded of a quote from the movie Butch Cassidy and the Sundance Kid by Struther Martin. “Morons . . . I have morons on my team . . . “

It is absolutely obvious that none of the above people have any understanding of the tax code.

Let me make this clear: I am not stating my position on this issue in this blog. I just want to inform you of how the tax system works and how the folks detailed previously could accomplish the task of taxing the rich without soaking the middle class.

In 1986 there was a far-sweeping tax law change that destroyed many businesses and wealth. I saw it happen first hand. The tax law redefined income and sources of income. And then it changed how deductions against that income could be used and how it was taxed. Income sources were divided into three separate buckets:

First is earned income. This is the income everyone is familiar with and the guys above can only seem to understand. It is comprised of W-2 wages and 1099 income. W-2 wages are normal paychecks that have federal and Social Security taxes deducted before you receive your net check. Income 1099 is income earned but no taxes are withheld upfront. It is the duty of the recipient to pay the taxes out of the income they receive.

The second bucket is portfolio income. This is comprised of interest, dividends, and capital gains or losses. Portfolio income is created by interest from savings, CDs, notes, and bonds and from dividends received from stock and or privately held businesses. Capital Gains or losses are generated from the sale of the security or ownership of a business. If you make money upon the sale you have a capital gain. If you lose money, you have a capital loss.

The third bucket is passive income. Passive income is most commonly created by rents received from real estate or royalties received from oil and gas properties. Each has its own special tax treatment and has specific deductions allowed. Simply stated, the income is taxable if it exceeds the expense incurred from the operation of the property. The same capital gains or losses occur if the property is sold.

Prior to the 1986 tax law, losses from one bucket could offset income from another bucket. There were many tax loopholes back then. The loopholes allowed for the creation of many crazy tax shelters. To eliminate these shelters and loopholes the 1986 tax law was enacted. It was far-reaching and nothing the taxpayer had done in the past was grandfathered, meaning that if you were involved in a tax shelter, the IRS could reach back for years at a time and charge income tax and penalties for the income tax you should have paid. This is where business and individual wealth were destroyed in an instant.

From 1986 forward to today and you can cross buckets of income and offset gains with losses only if your income does not exceed $125,000. Once your income exceeds this level you are not able to use losses from one bucket to offset gains and income from the other bucket.

Sorry for the long dissertation, but now for my point(s) illustrating that the aforementioned folks above do not understand the tax laws. Since the 1986 tax law, there are really no tax loopholes available. The legislature pretty much took them away. So when they say they want to increase the taxes on the wealthy, they are talking about bucket number one. They do not know of or understand buckets number two and three. The wealthy in many cases do not have a W-2, and many do not have 9 to 5 jobs like the rest of us. Nor, in most cases, do they have a 1099. So that negates soaking the rich by raising the income tax, bucket number one, since they do not have any earned income. This is where the “Morons” line comes into play.

We already have a progressive income tax, bucket number one. This means the more you earn the more you pay in income tax. If you want to tax the rich more because they are not paying their fair share, you must create a progressive tax on buckets number two and three. The wealthy make their income from interest, dividends, rents, and royalties whether from ownership of securities, property or businesses. It is funny that Warren Buffet states he is not paying his fair share of taxes and that he pays a lesser percentage of tax than his secretary. He does not quite come clean with his statement. He makes the majority of his money from dividends received and capital gains from the sale of his stock. His earned income is a modest salary and the income tax he pays on that salary is a very small percentage of his overall annual income, from at least two of the buckets.

I will reiterate: If you want to soak the rich, focus on buckets number two and three. By fiddling around with bucket number one you only harm the working middle class. And before I forget, the news reporters, news agencies and spin doctors are also to be included with the Morons listed above. They do not get it either.

Corey N. Callaway

Investment Advisor Representative